Nigeria’s Revenue Targets Threatened by Trump’s Energy Policy

As Nigeria strives to implement its ambitious N54.9 trillion 2025 budget, concerns have been raised by experts about the potential impact of President Donald Trump’s energy policy. Focused on increasing oil output, this policy could jeopardize the country’s $75 per barrel target, leading to consequences such as inflation and Diaspora remittances.

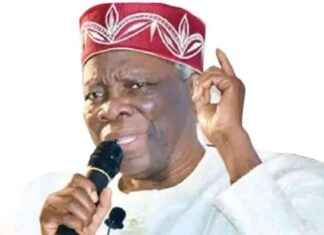

President Trump, known for his “Drill Baby Drill” energy policy, aims to bolster America’s fossil energy resources to meet domestic needs. However, analysts warn that this could result in oversupply and lower prices in the global oil market. Dr. Muda Yusuf, the director/CEO of the Centre for the Promotion of Private Enterprise (CPPE), emphasized that Trump’s policy could hinder Nigeria’s budget targets, escalate inflation, and disrupt Diaspora remittances.

Impact on Global Oil Output and Prices

The United States has been the world’s largest oil producer for the past six years, accounting for approximately 22% of global oil production. With plans to increase oil output significantly, the Trump administration could influence global oil prices and production levels. By creating a National Energy Dominance Council, President Trump aims to drive America’s energy dominance agenda, potentially affecting organizations like OPEC.

Furthermore, the Trump administration’s efforts to reduce global geopolitical tensions, such as the Russian-Ukraine conflict, could impact oil output. If successful, these initiatives could lead to increased global oil production, particularly considering Russia’s significant contribution to the oil market.

Threat to Crude Oil Price Benchmark

In light of these developments, there is a high likelihood of crude oil prices weakening in the near future. This could jeopardize Nigeria’s budget benchmark of $75 per barrel, impacting government revenue and foreign exchange earnings in 2025. Additionally, President Trump’s withdrawal from the Paris Accord and imposition of trade tariffs on major trading partners may further complicate the global economic outlook.

While lower energy prices could benefit economic players in Nigeria by reducing costs, the broader implications of Trump’s policies on global trade and supply chains are a cause for concern. The Trump administration’s focus on economic nationalism and protectionism has triggered retaliatory trade policies from various countries, potentially affecting trade alliances and economic growth.

Challenges and Opportunities for Nigeria

The potential implications of Trump’s energy policy extend beyond economic factors. High inflation, disruptions in global supply chains, and currency depreciation could further strain Nigeria’s economy. Diaspora remittances, government revenue, and budget projections are all at risk if oil prices fall below expectations.

Clifford Egbomeade, an analyst and communications expert, underscored the severe financial strain Nigeria could face if global oil prices decline. With oil revenues serving as a cornerstone of the country’s foreign exchange earnings, any significant drop in prices could lead to revenue shortfalls, increased debt, and currency depreciation.

Looking ahead, economic diversification emerges as a crucial strategy for Nigeria to reduce its reliance on oil revenues. By investing in agriculture, manufacturing, and services, the country can create alternative revenue sources and mitigate the impact of volatile oil markets.

Expert Insights and Recommendations

While some experts downplay the potential impact of Trump’s energy policy on Nigeria, others emphasize the need for proactive measures to safeguard the economy. Prof. Wumi Iledare, a leading petroleum economist, believes that demand and supply dynamics ultimately determine oil prices. He suggests that Nigeria should focus on building a self-reliant economy less vulnerable to global oil market fluctuations.

David Adonri, an analyst at Highcap Securities Limited, acknowledges the importance of crude oil to Nigeria’s economy but highlights the need to diversify revenue streams. As the country navigates the challenges posed by Trump’s energy policy, a focus on self-sufficiency and domestic production could help mitigate external economic shocks.

As Nigeria grapples with the uncertainties surrounding Trump’s energy policy, proactive measures and strategic investments in non-oil sectors will be crucial for ensuring economic stability and resilience in the face of global challenges.